|

Appendix I: Back-Home Plan by Participants

ALGERIA

ETHIOPIA

Introduction Today the issue of many countries is problem of poverty and unemployment. Most countries, especially developing countries use Micro Finance institutions (MFIs) to solve the problem of finance and promote Micro and Small Enterprises (MSEs).

MSEs in different countries face almost similar problems like: Ø Shortage of finance, Ø Lack of working premises, Ø Lack of marketing, Ø Lack of raw materials, Ø Lack of training, Ø Lack of proper organizational set up, Ø Lack of appropriate technology, Ø Lack of information and consultancy service, etc

Lack of access to finance (credit) remains the core problem of MSEs. This is due to low attention to the establishment and development of MFIs in many countries and inadequate distribution of MFIs.

Hence, my back-home plan is focusing on the ““Promoting the Community Based Savings and Credit Associations to Community Based Micro Finance Institutions”.

1. Objective Ø To enhance MSEs through establishing and strengthening CBMFIs. Ø To stabilize the finance sector by establishing many competitive MFIs.

2. Formulating Legal Frame - Work The existence of many Saving and Credit Associations (SCAs) is an opportunity to establish CBMFIs in Addis Ababa. Most of these SCAs are community based associations organized according to the principle of co-operative association, and some of them are financed by different NGOs.

These SCAs are supposed to provide credit only to their members on interest basis. SCAs are managed by committee elected by the general assembly. However, this time there is no due attention and enough support to these SCAs. Therefore, formulating the legal framework enables to establish CBMFIs and describe the role of Government Agencies and other stakeholders supporting and promoting CBMFIs.

3. Policy Related Issues In Ethiopia since the economic policy is market oriented and flexible there would not be as such difficulties to formulate conducive legal frame-work for the establishment of CBMFIs. Though, being this concept is new, awareness creation for SCAs, Government Agencies, NGOs and other stakeholders is important.

4. Action Related Issues In the process of establishment of CBMFIs, the strategy will focus on promoting the existing SCAs. Then establishing the new ones will be the next step. To reduce the risk which would happen in the process of establishing CBMFIs some SCAs will be selected for the pilot testing.

Here the role of Government Agencies would be issuing certificate and assisting managerial and technical supports. While NGOs are supposed to provide seed money and other supports to CBMFIs.

5. Time Frame To establish CBMFIs in Addis Ababa may take 3 years (2009-2011) implementation period. Accordingly the following major activities would be undergone: Ø Discussion with Higher Officials on the concept of CBMFIs. Ø Awareness creation for Government Agencies, SCAs, NGOs, etc. Ø Formulation of Legal Frame -Work. Ø Preparation of manuals, procedures, designing supervision mechanisms. Ø Selection of SCAs for pilot testing. Ø Establishment of CBMFIs

MADAGASCAR

SITUATION

It is a common feature of developing economies that access to finance for working capital and fixed asset investment is often extremely difficult for SME`s. Bearing in mind that the majority of Malagasy enterprises fall into the SME`s category, it is clearly of vital importance not only that investment be directed towards them, but also active encouragement should be given to promoting the development of SME`s.

Those SME`s that are too small and informal for the formal financial sector and that are having a too high loan demand for the MFI`s.

Now, Madagascar is faced with three main challenges with regard to improving SME`s access to financial services:

· The financial sector is dominated by a small number of banks that earn an acceptable income on their portfolio to corporate clients as well as non interest bearings products. These banks have no direct interest in expanding their products to SME`s. · There is a deep rooted mistrust between banks and SME`s. This distrust is characterized by banks indicating that SME`s do not present reliable documentation and financial statements and SME`s believing that it is more or less impossible for them to obtain a loan from the formal financial sector. Therefore, SME`s do not consider banks as partners in their business development. · The majority of SME`s are informally organized, without audited financial accounts. The business and private accounts are not clearly separated. Traditional loan appraisal that most banks use is based on documentation provided by the SME`s as well as a high emphasis on collateral. This credit methodology cannot be used as a reliable loan appraisal method for the SME`s market segment described above. Cash flow based analysis and an emphasis on more innovative and flexible collateral requirements are needed for these SME`s. However, most banks are reluctant to use this lending methodology and lack the knowledge as well as experience to implement such lending techniques MFI`s use as lending methodology that is closer to a cash flow based credit appraisal, but MFI`s often lack the funding and the institutional capacity to enter into SME`s finance which clearly opens roles for the future FINANCE SUPPORT CENTER. OBJECTIVE

The main objective of establishment of the FINANCE SUPPORT CENTER is to improve the access of SME`s to adequate financial services on a sustainable basis. The facilitated access to adequate financial services will safeguard the existence and promote the expansion of SME`s, stimulate the creation of new business and, hence, contribute to job creation and income generation. The establishment of the FINANCE SUPPORT CENTER contributes directly to the promotion of the private sector as well as to poverty reduction.

This FINANCE SUPPORT CENTER will provide financing funds as well as Technical assistance for banks, MFI`s who would on lend the funds to their SME`s borrowers and for SME`s themselves.

The funding gap must be addressed by the FINANCE SUPPORT CENTER.

FINANCE SUPPORT CENTER should play the role of providing sufficient fund to banks at a reasonable interest rates. This funds will be dedicated only to SME`s.

FINANCE SUPPORT CENTER should urge banks to finance SME`s and show them that SME`s sector is a quite reliable and profitable market segment, even when reasonable interest rates are being charged.

In order to regain the trust of banks and create a new image for SME`s, FINANCE SUPPORT CENTER should provide Technical Assistance for SME`s to help them to present a reliable documentation and financial statements. So banks can consider them as reliable-profitable partners.

The FINANCE SUPPORT CENTER should also provide Technical Assistance to the banks in order to improve their knowledge and skills on SME`s finance and to increase and improve their financial services to SME`s. Technical Assistance thus helps banks to have enough skills to assess SME`s that do not fulfill the traditional credit appraisal requirements (Audited financial statements, valued collateral…etc), besides, FINANCE SUPPORT CENTER should give Technical Assistance to bank to adapt their lending technology to assess SME`s that are less formal and less well developed as their average customer, by this way FINANCE SUPPORT CENTER shows banks that the risks in this sector can be mitigated by an innovative and appropriate lending technology and that SME`s can be an interesting clients for a profit oriented banks.

This FINANCE SUPPORT CENTER should also provide Technical Assistance/Advice to MFI`s to adapt their lending methodology to cope with SME`s that have bigger financial needs that their average customers.

The Technical Assistance program offered by FINANCE SUPPORT CENTER will need to be able to provide the technical support to implement these two approaches.

This FINANCE SUPPORT CENTER should also provide funding to MFI`s. The microfinance sector generally experiences a shortage in funding sources. So FINANCE SUPPORT CENTER should give them funding in order to allow them to grow as fast as they would like and to increase their loan portfolio.

HOW TO ACHIEVE AND TIME FRAME

The FINANCE SUPPORT CENTER should be set up as a Greenfield institution, building up the organizational structure as well as the human capacity from scratch. The establishment of this institution could take 6-8 months.

Resources: A principal office in Antananarivo with a staff of about 15-20 employees would be sufficient to operate this FINANCE SUPPORT CENTER.

The staff will be recruited by the management and can receive training tailored to the needed skills and knowledge for banks, MFI`s and SME`s.

· A funding department : In charge of maintaining contacts with government, shareholders (if any), and lenders (Banks or MFI`s). Identifying and negotiating with potential investors and lenders, catering for sufficient funding of the FINANCE SUPPORT CENTER activities and administrating global loans.

· A loan marketing department : That identifies potential on lending bank and MFI`s and also SME`s which are interested for the program. That is also responsible that global loans are disbursed strictly according to the stipulations of the contracts (eg: type and size of loan and beneficiaries, purpose of loan….etc).

· A training department : That is coordinating and/or extending Technical Assistance(including IT assistance) to the on lending banks, MFI`s or SME`s to enable them to achieve the goals set in agreements between FINANCE SUPPORT CENTER and the on lending Banks, MFI`s or SME`s.

· IT department and Internal supervision : That assures all IT system, internal supervision, monitoring and reporting.

NAMIBIA

Background on the regulation of SACCOs in Namibia

Since the promulgation of the Co-operatives Act, (Act No. 23 of 1996) in 1996 which makes provision for the establishment of all types of co-operatives in Namibia, close to 180 different types of co-operatives were registered. Some of these are pure SACCOs while the others are multipurpose co-operatives with savings and credit schemes.

During the past twelve (12) years, which the Division of Co-operative Development (DCD) has been administering the Co-operatives Act, a need to have prudential rules specifically for SACCOs has been identified. Thus, the Division has the responsility to facilitate the formulation and implementation of prudential regulations for financial co-operatives.

MAIN OBJECTIVE To create a conducive environment for the establishment and growth of properly regulated SACCOs in Namibia.

SPECIFIC OBJECTIVES

§ To set clear and specific regulations for SACCOs and Savings and Credit Associations (SCAs) operating under registered multipurpose co-operatives § To strengthen the regulatory measures for SACCOs and SCAs § To have all SCAs currently operating under multipurpose co-operatives registered as SACCOs and operating independently of those co-operatives.

RESOURCES REQUIRED The following resources would be required to achieve this objective:

§ Human resources The Management and Training subdivision in the DCD will be responsible for the information workshops with the assistance of the Rural Institute for Social Empowerment (RISE)-Namibia (the NGO which has since 1998 been promoting all Savings and Credit activities that are operated under registered multipurpose co-operatives). The aim of the information workshops would be to sensitize the members of SCAs on the need for specific regulations for SACCOs.

§ Financial resources The DCD in the annual budget of the Ministry of Agriculture, Water and Forestry has made budgetary provision for these activities. Additional financing if needed would be sought from stakeholder Ministries and local as well as foreign NGOs, eg. GTZ.

OPERATIONAL ASPECTS

§ The DCD as the lead promoter of non-bank savings and credit activities and custodian of the Co-operative law in Namibia will select a team of two (2) staff members from the management of the division who will be sent on a familiarization study visit to Kenya (the African country with the most advanced MF sector). § The main aim of the study visit would be to study the prudential regulations used in that country and to see how they applied in practice. § The team will share its findings/experiences from the study visit with other stakeholders to solicit their views on the findings. § The DCD will then request or contract the services of a resource person through our counterpart in Kenya. The resource person would work together with selected two(2) staff members who participated in the study visit during the drafting of the regulations.

Stakeholders The DCD will work together with other stakeholders in the sector. The main stakeholder in this plan would be RISE-Namibia which has been since 1998 promoting savings and credit activities under registered co-operatives in the North Central Regions of Namibia.

OUTPUT EXPECTED

It is expected that after the draft is presented and accepted by the stakeholders, three (3) different incesption workshops would be held for the board members of all SACCOs and SCAs. The purpose of the workshops would be to give an indepth explanation of the regulations to these board members who will have the responsibility of implementing them, under the supervision of RISE. The formulated regulations should be finalised and ready for implementation by April 2010.

TIME FRAME

In conclusion Ladies and Gentlemen, we have just presented to you our plan, but due to the fact that this plan was prepared here in Jakarta-Indonesia by the two of us, and without the involvement of our supervisors, this plan, especially its time frame is subject to change.

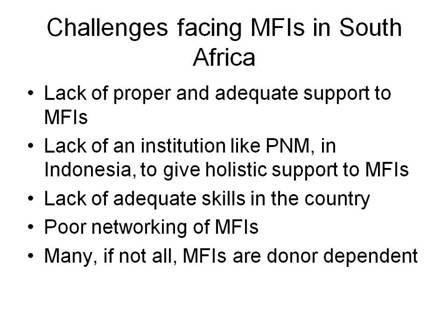

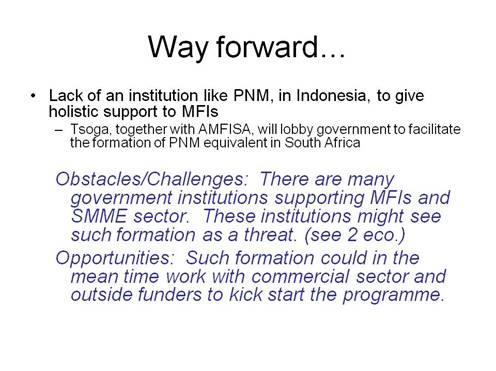

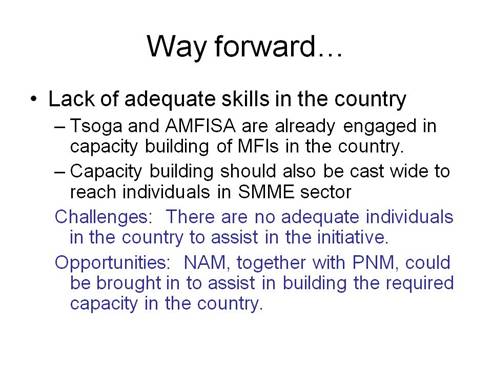

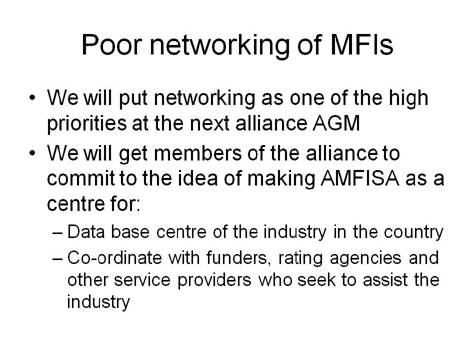

SOUTH AFRICA

SUDAN

In the framework of training plan it is my pleasure to introduce to you my back home plan. My plan is just to promote some of the Indonesian experience in the field of M.F in both conventional and Sharia methods.

The recognition of M.F as one of the priority sectors for Sudan started only in the mid 1990’s. The financial regulation of the bank of Sudan are still being revised and lack proper identification of M.F activities.

M.F in Sudan is now traditional Islamic financial products, such as the Murabaha, the Salam the Musharaka and Mudaraba. Murabaha play an important role in Sudan. For example, the Murabaha is a buy and resell contract, under which the bank purchases the good ordered for the client and resell it to the customer at a marked-up price, usually in a differed payment basis. This is the preferred product and is also the closest to the standard interest-bearing financial contracts. The Salam is also a buy and resell contract, but here the bank purchases the good from the client who then deliver goods in the future. Salam mainly used for agricultural product. The bank pay the farmer on the day of the contract to signed and the farmer delivers the crop to the bank after harvest.

This method of Salam can be applicable in the Sudan namely because it is an agricultural country.

We have also in Sudan a number of banks, NGO’S and social fund which could be involve with M.F. So during two years plan more MF is will slowly being launched. My forcasting is that over 1990’s local and foreign NGO’S will be in direct coordination with government authorities in the 1st years, and also will be very active in providing micro credits, emergency loans, medical care and educational services to poor people in the Sudan. In addition to that many rural development projects will be included in M.F. support. In the 2nd year plan I will expect the above mentioned figures and deals will be doubled.

In Sudan MF NGO”S have been much closer to grassroots operation than have the formal lending institutions. The main NGO”S active in micro credit have between 15-20.000 client. My plan aiming to double this figure in the first year and triple it in the 2nd one and this will be executed successfully if other things remain constant. Their success is often due to being community based ; often having simple procedures ; adopting flexible collateral terms and sometimes creatively partering with the formal banking system. They have to finance a variety of activities. They were adopt different MF mechanisms and approaches.

Finally my plan is also aiming to support some of the MFIS making a difference in the Sudan, one of them named SUMI, the Sudan micro finance institution, SUMI is an innovative and high-risk M.F institution based in southern Sudan helping small borrowers eager to grow their fledging businesses.

Conclusion

I expect that the great republic of Indonesia to lead all the Islamic world towards Sharia system in M.F because practically it has done a lot of work concerning this matter. The role of this great country is to distribute this method by all means of communication i.e through internet and conferences that should be held all over the world.

UGANDA

Background

The Third Country Training Programme on Microfinance for African Region – Establishing and Managing Microfinance Institutions was sponsored by the Government of the Republic of Indonesia under the framework of Technical Cooperation among Developing Countries (TCDC) Programme with the Government of Japan through Japan International Cooperation Agency (JICA). The implementation was done by the Non-Aligned Movement Center for South-South Technical Cooperation and delivered by resource persons mainly from PNM.

The course was attended by participants from 8 African countries including: - Algeria, Namibia, South Africa, Madagascar, Zambia and Ethiopia. Uganda was represented by Mr. Geoffrey Dutki of Stanbic Bank, Uganda and Mr. Colin Agabalinda of the Rural Financial Services Program of the Ministry of Finance, Planning & Economic Development.

Appreciation

We wish to express our utmost gratitude of the Government of the esteemed Peoples Republic of Indonesia, the Government of Japan / JICA and NAM CSSTC for giving us an opportunity to attend this training programme on Microfinance for African Region “Establishing and Managing Microfinance Institution”.

Through this programme, our minds have been exposed to the vast potential offered by the Microfinance industry to the economic development of Indonesia, through supporting the Small, Medium & Micro Enterprises (SME’s). Furthermore, we have been exposed to, among others, a new form of financing, namely Sharia Financing.

We wish especially to recognize Mr. Achmad Rofi’ie and Nina Sudiro, along with the entire team at NAM CSSTC, who put in a lot of effort to ensure the smooth and successful running of the training programme. We wish to assure you that your efforts shall bear fruit, through the development of the microfinance industry in Africa.

Way – Forward for Uganda

The programme introduced us to microfinance best practices through topics such as: - Loan Analysis, Business Planning, Product Development, Assets and Liability Management among others, for both conventional and sharia models of microfinance.

The training further exposed us the Indonesian government approach of supporting Microfinance and SME through the PNM. Based on these lessons, we have brainstormed and are now glad to put forward a simple, achievable back-home-action plan for 2009 – 2011 that we hope if supported shall benefit Uganda’s Microfinance Industry. The plan is based on two broad areas: -

1. Policy Advocacy on the nature of government intervention 2. Product Development for MFIs

The plan is presented in the 2 Tables (A&B) below: -

Table A - Government Support to MFIs & SME Development

Table B - Product Development for MFIs

ZAMBIA

INTRODUCTION

The Third Country Training Programme on Microfinance for African Region was held in Jakarta and Jogyakarta from 27th October to 11 November 2008. At the end of the training, participants were expected to develop a ‘Back Home Plan’ focusing on how to promote the microfinance sector in their respective countries.

OBJECTIVE

The objective of this Back Home Plan is to develop a comprehensive Microfinance Policy in Zambia with the aim of developing a vibrant microfinance sector and consequently, enhance the development of the Micro, Small and Medium Enterprises Sector.

ORGANISATION’S MANDATE

The Government of the Republic of Zambia, attaches great importance to the development of the micro, small and medium enterprises as this is viewed as the engine of economic growth, contributing to employment creation and poverty reduction. One of the strategies to develop the MSMEs is by addressing the issue of microfinance.

The Ministry of Commerce, Trade and industry is the lead Ministry in promoting micro, small and medium enterprises. The Ministry is mandated to promote the micro, small and medium enterprises by identifying sources of finance for the MSME sector, in association with support institutions and implementing agencies in order to provide information on access to funds for MSME development.

RESOURCES REQUIRED

In order to achieve the objective stated above, the following resources are required:

a) Human Resources – Consultancy services would be required as well as support staff; and b) Financial Resources– this is required in order to effectively undertake the exercise.

IMPMENTATION ASPECT

The process of implementing the Back Home Plan will involve wide consultations with the Central Bank, microfinance institutions, microfinance associations, Government agencies, Micro, Small and Medium Enterprises, private sector, public sector and cooperating partners.

EXPECTED OUTPUT

The eventual output of the Back Home Plan is a comprehensive Microfinance Policy to promote the MSMEs through enhancing the performance of the microfinance institutions.

The long term benefits would be the following: (a) Increased economic growth; (b) Employment opportunities; (c) wealth creation; and (d) Poverty reduction.

WORKPLAN

In order to undertake the development of the Policy the following work plan is being proposed:

ASSISTANCE REQUIRED

The Government of the Republic of Indonesia has been successful in development and implementation of the Microfinance Policy and consequently, the development of the micro, small and medium enterprises.

In this regard, the Government of the Republic of the Zambia would require consultancy services from the Government of the Republic of Indonesia. It is not necessarily that the same Indonesian policy would be duplicated in Zambia because of different economic and geographical environments existing in the two (2) countries. The policy should take into account the existing environment in Zambia and consequently provide strategies and measures of how to develop the microfinance sector.

CONCLUSION

Development of a Microfinance Policy aimed at creating a vibrant microfinance sector is important to the development of the micro, small and medium enterprises and consequently, creating employment and poverty reduction.

To this effect, the Zambian Government will endeavor to develop a Microfinance Policy in order to develop the microfinance sector.

|